Mystockimages/E+ via Getty Images

While the shoes we put on our feet are often the subject of significant thought because of their impact on the quality of life and the perception that others have of ourselves, retailers specializing in the sale of shoes are often neglected. This seems to be especially true when you put it in reference to the investment community. One such player in this market worth considering is a company called wedges (CAL). Apparently due to the COVID-19 pandemic, Caleres has had a tough time lately. But some of its problems also existed before the pandemic in the form of inconsistent profits and even net losses. Fortunately for investors, the worst for the company is over. And on top of that, stocks are trading today at levels that look quite attractive on an absolute basis and are probably more or less fairly priced on a relative basis. This could leave room for patient, value-oriented investors to step in and grab a piece of a valuable company on the cheap.

A specialist retailer

Originally founded as the Brown Shoe Company, Caleres has grown into a fairly large specialty retailer in the shoe market. Through its retail shoe stores and e-commerce sites, the Company sells shoes for men, women and children. In fact, in its last completed fiscal year for which data is available, 61% of revenue was attributable to women’s footwear. Another 23% was attributed to men’s shoes. Children’s shoes account for 10% of sales. And other clothing and accessories made up the final 6%.

At first glance, the name Caleres may not be recognizable. But the company’s biggest brand, Famous Footwear, probably is. In its last fiscal year for which data is available, this particular unit accounted for approximately $1.26 billion, or 59.7%, of sales generated by Caleres. Through this segment, which includes access to over 900 famous shoe outlets, the company sells a variety of brands ranging from Nike (NKE) to United States (SKX) to Crocodile (CROX), and more. General prices for these products range from $20 to $260.

The other key segment of Caleres is its brand portfolio segment. Through this, the company offers retailers and consumers access to leading brands, the former through its wholesale operations and the latter through direct-to-consumer retail and e-commerce functions. Brands included in this segment include Naturalizer, Vionic, Sam Edelman, Dr. Scholl’s Shoes, Blowfish Malibu, etc. On the wholesale side, the company reaches around 4,200 retailers while on the retail side, it operates 90 stores. This particular segment was responsible for approximately 40.3% of the company’s overall revenue in its last completed fiscal year.

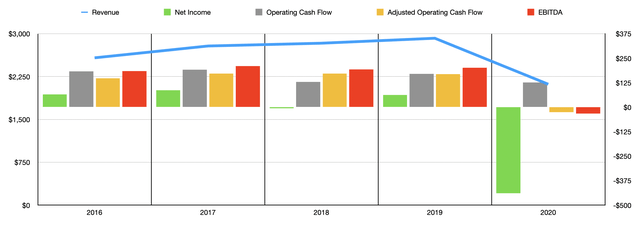

Author – SEC EDGAR Data

Over the past few years, Caleres’ financial performance has been quite attractive after seeing its revenues drop from $2.58 billion in 2016 to $2.92 billion in 2019 and then they dipped to $2.12 billion. dollars in 2020. Not only was there lower demand due to the COVID-19 Pandemic, there was also management’s decision to close some of its outlets. At the end of 2019, for example, the company had 949 stores in operation in its Famous Footwear segment and it operated 228 locations in its Brand Portfolio segment. A year later, the number of locations had fallen to 916 and 170, respectively. However, it would be a mistake to say that the 2020 financial year was the only difficult one for the company from this point of view. The number of stores was even higher in 2018, reaching 992 and 229 respectively. and 90. Helping the company, albeit only modestly, is the amount of revenue it generates from its e-commerce arm. At the end of last quarter, online sales accounted for just 13% of the company’s overall revenue.

The company’s net profits have been all over the place in recent years. In two of the last five completed fiscal years for which data is available, the company actually generated net losses. Fortunately, cash flow has been a bit more consistent. Between 2016 and 2019, it moved in a fairly narrow range between $129.6 million and $191.4 million in 2020, the cash is still robust, totaling $126.4 million. However, if we correct for changes in working capital, the picture changes somewhat. The range in the four years before the pandemic was between $147.8 million and $171.6 million. But then, in 2020, it was negative at $25.5 million. A similar relationship can be seen when looking at EBITDA. In 2020, this amount was negative $32.4 million.

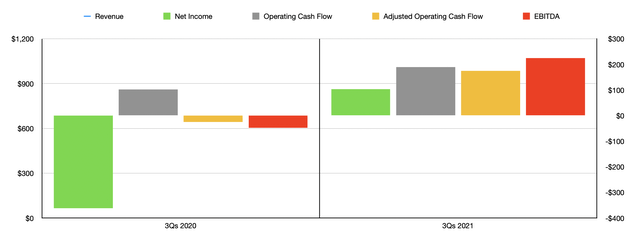

Author – SEC EDGAR Data

The good news for investors is that the worst seems to be over. In the first nine months of 2021, for example, sales reached $2.10 billion. This represents an increase of 35.7%, with much of this growth attributed to comparable store sales growth. Net profit of $103.2 million marked a significant turnaround from a loss of $362.1 million in the same time a year earlier. Operating cash flow of $189.7 million exceeds the $101.8 million reported in the first nine months of 2020. And the adjusted equivalent of that amount was $174.8 million, although higher than the $25.1 million in outflows the company saw a year earlier. During this time, EBITDA went from a negative $47.9 million to a positive $224.5 million.

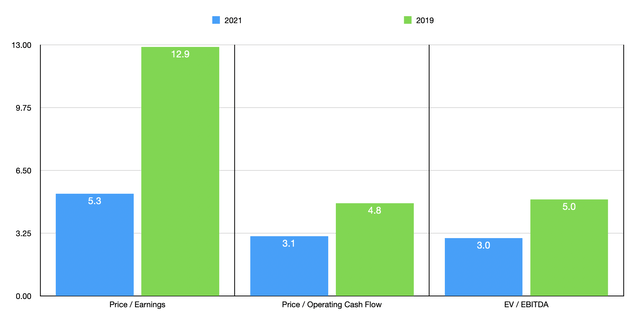

For fiscal 2021, management expects earnings per share to increase to between $3.29 and $3.39. If we make some adjustments, we expect earnings per share to be between $4 and $4.10. This would imply a mid-term profit of around $154.3 million. This would give us a price/earnings multiple of 5.3. This compares to the 12.9 we get if we go by the 2019 numbers. That said, I don’t believe earnings are a good measure of the success or failure of this business. I say this because of the extreme volatility they have shown in recent years. Cash flow is a much better determinant of its potential. If we assume that earnings improvement in the last quarter of 2021 has the same impact on operating cash flow and EBITDA, then those metrics should be around $261.3 million and $335 million. .6 million, respectively. This would imply multiples of 3.1 and 3, respectively, for the 2021 financial year. This compares to multiples of 4.8 and 5, respectively, if we rely on 2019 data for the company.

Author – SEC EDGAR Data

To put the price of the company into perspective, I decided to compare it to five similar companies. On a price-earnings basis, these companies ranged from a low of 6.1 to a high of 15.2. Our 2021 results would imply that our prospect is the cheapest of the bunch while the 2019 calculation would have four out of five companies cheaper than our target. Using the price/operating cash flow approach, the range is 3.8 to 13.8. Again, using 2021 numbers, Caleres was the cheapest of the bunch. And using 2019 numbers, it was cheaper than all but two. Finally, we come to the EV to EBITDA approach. This gives us a range of 2.5 to 8.4. Using 2021 numbers, a single lead was cheaper than our business. And using 2019 numbers, four out of five were cheaper.

| Company | Price/Benefit | Price/Operating Cash Flow | EV/EBITDA |

| wedges | 5.3 | 3.1 | 3.0 |

| Destination Group XL (DXLG) | 7.2 | 3.8 | 4.1 |

| Tilly (TLYS) | 6.7 | 6.2 | 2.5 |

| Guess (GES) | 8.7 | 12.8 | 4.6 |

| Boot Barn Holdings (BOOT) | 15.2 | 13.8 | 8.4 |

| Shoe Carnival (SCVL) | 6.1 | 4.7 | 3.2 |

Carry

As you can see from Caleres’ valuation against its peer group, the company’s price position varies significantly depending on the year we are basing the data on. What’s important to note is that, even on an absolute basis, stocks look pretty cheap no matter what case we’re looking at. Add to that the fact that the company is showing some sort of turnaround, and this could be a good opportunity to consider. But make no mistake. This prospect is not a quality trader. Going forward, I fully suspect management will continue to close locations. And I foresee significant volatility for the business year over year. Instead of being a high-quality trader trading at low prices, it’s more like the cigar butt stocks that Benjamin Graham liked to buy into. This could make for some nice short-term upside. But I don’t believe that’s a solid prospect for long-term investors.